What seems like many lifetimes ago, Lebanon was dubbed the “Jewel of the Middle East,” a distinction infused into every citizen’s core identity, including the thousands of Armenians who found salvation and restoration as genocide survivors after World War I. Today, amid the financial meltdown that some historians are comparing with the hyperinflation period in the post World War I Weimar Republic (1918-1923), for which Germany suffered a humiliating defeat, the Lebanese masses are suffering the persistent degradation of their own dignity, in front of gas stations, pharmacies, hospitals, and bakeries.

However, the calamity in which the Lebanese are trapped is not due to a foreign enemy so much as the defeat of their own leaders in government, institutions and business, many of whom are regarded by the people as the enemy within.

Many Lebanese Armenians, who came of age in the golden days of the 1950s and 1960s were gripped by the nostalgia of the past, sharing their heirloom photos of a bygone era depicting the Parisian flair of “downtown” Beirut, the idyllic beaches of Byblos, the glamorous bars and clubs of Jounieh. This was the generation that enjoyed the upwardly mobile comforts of an international city bustling with innovative commerce, foreign travel and European imports of every variety. It was beyond their comprehension that their own children would be subjected to 15 years of street fighting which lasted until 1989, when Lebanese warlords signed on to the Taef agreement, putting an end to the hostilities and promising economic prosperity.

With the economy booming again, thousands of Lebanese who had lost their businesses during the civil war took advantage of the reconstruction of Beirut, only to see their renewed dreams dashed once more with the 2006 Israeli invasion of Lebanon. This event ultimately destroyed the business and investor class, for which political stability is essential.

While economic downturns and even collapses of markets are common throughout history, a nation built on a fragile political system is especially vulnerable to economic upheavals because the government lacks the basic infrastructure to give incentives to the middle class. This was the case in Lebanon, where every political adventure risk further exposed the middle class. Today, this class has all but vanished, thrusting the working class into poverty. Only the wealthiest count on their foreign bank accounts to see them through what may or may not be the worst of it.

In June 2021, the World Bank released a report warning that the economic crisis in Lebanon risks becoming one of the three most severe since the mid-19th century

Life in a Failed State

One man, ruminating over the loss of his accumulated wealth said half-heartedly, “Now we are all communists, see? Rich and poor, all are ‘equal’.” He may have a point, when one walks the cosmopolitan streets of Hamra and Jmeyzi which have not been the same since before 2019 when the political and economic rumblings were underfoot. For the first time, we witness Lebanese beggars and child laborers as an ordinary state of affairs. On the first anniversary of the Beirut Blast, one man in his late 40s, held up a poster saying, “Please help me, my daughter needs milk, I am Lebanese.”

Amid the ongoing economic and financial uncertainties and the collapse of the state, people fear that anarchy may spread across many towns.

Ominous Indicators

According to a World Bank Report (June 2021), more than half the population is likely below the national poverty line. Moreover, the fluctuation of the Lebanese currency and the dollar shortage forced the closure of 785 restaurants and cafes between September 2019 and February 2020, resulting in 25,000 employees losing their jobs. The trend continues and many economic analysts predict that by the end of 2021, the private sector may face even more dire hardships.

Inflated Prices, Deflated Hopes

Furthermore, when banks have stopped giving short-term loans to businesses and no longer provided them with U.S. dollars for imports, it unleashed hyperinflation at an alarming rate, triggering a massive loss of purchasing power and an increase in hardcore poverty. Washington Post (April 2021) has reported that the price of sugar increased 670%, while wheat, tea, rice, and cigarettes skyrocketed 1000% over the same period. To add to these economic woes, the typical family or business has as little as one or two hours of electricity per day; generators are not fully functioning due to the absence of fuel oil in the market; hospitals cannot afford to function due to medical and equipment shortage. Finally, anecdotal evidence suggests that it is impossible to make a trip to the supermarket without spending at least 1,000,000 Lebanese pounds (equivalent to 650 USD in official and 40 USD in black market rate as of 12/13/21) for basic goods.

In June 2021, the World Bank released a report warning that the economic crisis in Lebanon risks becoming one of the three most severe since the mid-19th century. Another report stated that Lebanon needs at least 12-19 years to witness an economic recovery.

An Uptick in Crime

According to Pierre al-Khoury, a public affairs researcher of the Board of Directors of the Lebanese Economic Association, all these factors have contributed to a dramatic increase in crime rates. According to sources from the Internal Security Forces (ISF), as the country sinks further into a crippling financial crisis, many families with little means to maintain their livelihood are engaging in “hunger crimes.” An anonymous source from the security forces revealed that the crime rates in Lebanon hit a six-year peak this year and have increased 17% from last year.

Lately, the armed robberies in pharmacies have also increased. Where thieves with light weapons are breaking into pharmacies, pointing their guns at the pharmacists and demanding certain medicines, which if not available, then cash. Similar incidents have occurred in different areas in Mount Lebanon and as far as villages near the border with Syria where armed men robbed pharmacies of cancer drugs. In Tripoli, one of the poorest coastal cities of the Mediterranean Sea to the north of the country, robberies were also recorded. Locals complained that a group of young men on motorcycles stole food and medicines from bakeries and pharmacies. A few Market owners noted that these acts “are not the result of security problems but an economic challenge.”

Meanwhile, with the absence of authorities, people are realizing they are living in a failed state.

What Went Wrong?

Lebanon’s financial collapse since 2019 is a story of how a vision for rebuilding a nation was derailed. Downtown Beirut, razed in the civil war, rose from the ashes with skyscrapers built by international architects and swanky shopping malls filled with designer boutiques that took payment in dollars. Despite the reconstruction efforts, the Lebanese public debt maintained what is the equivalent of 150% of national output, one of the world’s highest burdens.

Disaster on the Horizon

After the civil war, consecutive Lebanese governments balanced their economy with tourism receipts, the flow of cash from the repatriates, foreign aid, earnings from its financial industry, and direct investments from the Gulf Arab states, which bankrolled the state by bolstering central bank reserves. With the rise of Iranian influence in Lebanon, Arab Gulf states turned their attention away from Lebanon. The Lebanese economy started facing a budget deficit as transfers failed to match imports. The banks started making loans to the government and began offering remarkably attractive interest rates for new deposits and even more extraordinary rates for Lebanese pound deposits. Attracting foreign depositors, dollars began flowing again and banks could keep funding the ill-begotten system.

A False Sense of Security

Before the financial tsunami hit Lebanon, unemployment and poverty existed, but were manageable. The youth were still living relatively carefree lives, attending parties and restaurants on weekly basis, traveling abroad, and enjoying vacations. But this false sense of financial freedom was based on living off of the very high interest rates on bank deposits. The investment of the middle class was limited to the service sector and real estate while industry and agriculture, the backbones of an economy, were completely neglected.

The Last Straw

The perfect storm was forming for the free-fall in which Lebanon is currently suspended. When the state needed cash for spending, banks refused to provide additional loans until the government made economic reforms and paid its debts. The government’s failure to deliver such reforms prompted foreign donors to withhold billions of dollars in the economic aid previously pledged.

In October 2019, the government devised a plan to raise taxes and introduce austerity measures, igniting mass civil society protests. Fed up with the corruption and fake reform promises, street protests in Beirut and Tripoli spilled over across Lebanon.

Interestingly, these mass protests, driven by a crestfallen youth demanding wholesale change, erupted against a political elite, many of them aging warlords who thrived while others struggled. Many protestors hold the banks responsible for the current situation as they were the main sponsors of the unfair economic system, hence some banks were physically attacked. The response by the Central Bank was to close its branches until further notice.

To add to the pain, the man-made explosion on August 4 at the Beirut port, which killed around 200 people and left thousands injured and homeless, caused billions of dollars of damage. Lebanon became a failed state.

From Bad to Worse?

The bestselling book Why Nations Fail, written by the Turkish born Armenian-American economist Daron Acemoglu and James Robinson indirectly summarizes the theory behind Lebanon’s exclusive political and extractive economic institutions. As the financial situation worsens, security problems will arise and the situation will quickly deteriorate. Already, many neighborhoods around the country, in collaboration with municipalities or local political parties, are organizing “local security guards” to patrol the streets after midnight. This can be already be seen in parts of Beirut. However, such actions, in the long run, may create instability, as local factions replace state security institutions and clash with rival factions. What further complicates matters is that such initiatives can lead to an increase in the purchase of illegal weapons. As the prices are hiking, arms sold on the black market are becoming an ordinary “part-time” job for many Lebanese.

The chapter on the Lebanese “golden age” ended a long time ago, but no one imagined that the brilliant Jewel of the East would one day become another vintage photo in a box of memories.

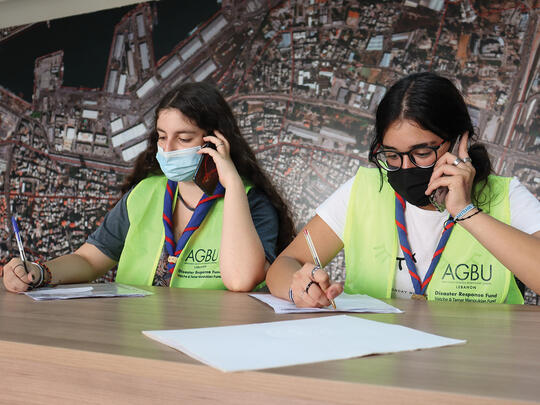

Banner photo by Hassan Ammar/AP